The Finance and Economics Thread

Oil falls below $60 as gasoline prices continue march toward $1.50 per gallon

http://biz.yahoo.com/ap/081111/wall_street.html

Why AIG Is Devouring the Bailout Fund

http://biz.yahoo.com/usnews/081110/10_w ... -budgeting

http://biz.yahoo.com/ap/081111/wall_street.html

http://www.nytimes.com/2008/11/11/us/po ... 1auto.html

America's Two Auto Industries

http://biz.yahoo.com/ap/081111/wall_street.html

At least it's getting less expensive to drive to the mountains.HOUSTON (AP) -- Retail gasoline prices dipped for a 17th week since July 4, falling below $2 a gallon in a number of states and approaching $1.50 at some service stations.

While consumers, worried about a weak job market and slumping investments, are grateful for the price relief, economic reports increasingly suggest they're hanging onto whatever savings they see at the pump.

Oil prices hit a 20-month low Tuesday as Wall Street offered yet more evidence that consumers have gone into hiding.

Why AIG Is Devouring the Bailout Fund

http://biz.yahoo.com/usnews/081110/10_w ... -budgeting

Wall Street sees few industries left unscathed by struggling consumersWhen the nearly insolvent insurance giant took an extraordinary $85 billion loan from the government in September, it signaled that financial tremors were spreading beyond Wall Street banks into other industries--and into 130 countries where AIG does business. In October, AIG got another infusion of $38 billion from the feds, as the stock markets tanked and the economy careened downward. Now, as AIG has announced a mammoth $25 billion third-quarter loss, the government has essentially scrapped its first two AIG rescue plans in favor of more aggressive treatment that reveals how much intervention is still required to prevent a financial epidemic.

The new plan effectively lowers the interest rate AIG must pay the government on $60 billion worth of loans and extends the payback period from two years to five. The government will also buy $40 billion in AIG stock and spend an additional $50 billion or so buying AIG-held securities that nobody else wants right now, at any price.

http://biz.yahoo.com/ap/081111/wall_street.html

Obama Asks Bush to Provide Help for AutomakersIt's becoming clearer to the market that it's going to be hard to rely on consumers to pull the economy out of its downturn. Late Monday, Starbucks Corp. reported lower sales across the coffee chain, and early Tuesday, Toll Brothers Inc. posted a sharp drop in revenue and said it was too difficult to predict what the luxury homebuilder's profit would be next year.

Funding problems were a big reason American Express Co. asked the U.S. government to become a commercial bank; late Monday, the credit card lender was approved to accept deposits and access the government financing that other banks have been using.

GM shares fell 44 cents, or 13.1 percent, to $2.92, while Ford Motor Co. fell 18 cents, or 9.3 percent, to $1.75.

"It's just not pretty," said Ken Mayland, president of research firm ClearView Economics. "When the alternatives are either socializing GM or having it go through a very painful bankruptcy, neither of those are happy outcomes."

Corporate bankruptcies have been piling up: soon after Circuit City Stores Inc. filed for Chapter 11 protection Monday, the Yellowstone Club -- a mountain retreat for the wealthy -- said it filed for bankruptcy after failing to secure new financing.

http://www.nytimes.com/2008/11/11/us/po ... 1auto.html

Seems to me if you're burning through that much cash, there is something seriously wrong with your business model.Mr. Obama has called on the Bush administration to accelerate $25 billion in federal loans provided by a recent law specifically to help automakers retool. Late in his campaign, Mr. Obama proposed doubling that to $50 billion. But industry supporters say the automakers, squeezed both by the unavailability of credit and depressed sales, need unrestricted cash now[WTF???], simply to meet payroll and other expenses.

The major automakers — G.M., Ford and Chrysler — are each using up their cash at unsustainable rates. The Center for Automotive Research, which is based in Michigan and supported by the industry, released on Election Day an economic analysis of the impact of one or all of them failing. If the Big Three were to collapse, it said, that would cost at least three million jobs, counting autoworkers, suppliers and other businesses dependent on the companies, down to the hot-dog vendors and bartenders next door to their plants.

America's Two Auto Industries

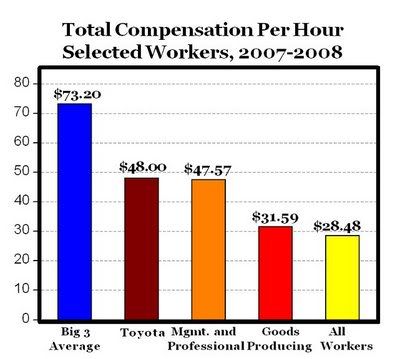

America has two auto industries. The one represented by GM, Ford and Chrysler is Midwestern, unionized, burdened with massive obligations to retirees, and shackled to marketing and product strategies that have roots reaching back to the early 1900s.

The other American auto industry is largely Southern and non-union, owes relatively little to the few retirees it has, and enjoys a variety of advantages because its Japanese, European and Korean owners launched operations in this country relatively recently. Their factories are newer, their brand images and marketing strategies are more coherent -- Toyota uses three brands in the U.S. to GM's eight -- and they have cars designed for the competitive global market that exists today.

Honda Motor Co. sells one basic Civic world-wide. Ford sells two different versions of its rival Focus compact car. Ford is engineering one Focus to take advantage of global economies of scale, but the new car won't hit the U.S. market until 2010.

The New American auto industry employs about 113,000 people, according to a recent study by the Center for Automotive Research. The economic slump is hammering sales and profits for these manufacturers, too. But they aren't looking for subsidies, and probably wouldn't get any since the rules governing the auto industry aid proposals to date effectively exclude them.

So this debate is strictly about the Old American auto industry, represented by the "Big Three" of Detroit. The Detroit Three employ more than 200,000 people directly, and sustain nearly 3 million more indirectly, according to the CAR study. Diminished as they are, the Detroit Three still account for about 4% of U.S. gross domestic product. They also represent a way of doing business that has run its course. GM's plea for a federal bailout makes that official.

Heres the application for free money...

http://www.taxpayer.net/user_uploads/fi ... cation.pdf

http://www.taxpayer.net/user_uploads/fi ... cation.pdf

Bail-Outrage: Misuse of Funds, Lack of Transparency a National Disgrace

Five Lessons from the Second AIG BailoutYahoo tech-ticker wrote:Many Americans are understandably outraged by the bailout fever that has gripped Washington this year. But even those who believe the bailouts are a "necessary evil" would have a hard time defending some of the bailout-related items that have come to light in recent days, including:

* Financial institutions using TARP bailout money to pay executive bonuses. The firms, of course, say it's "different" money and bonuses are key to retaining top employees. But if you need to come to the government for a handout, shouldn't your executives forgo a bonus? Or shouldn't the government make canceling bonuses a condition of getting aid, as is the case in Europe? [WTF?? These "key" employees are the same slimeballs that ran these companies into the ground and are ripping us taxpayers a new one.]

* The Fed refusing to reveal who received almost $2 trillion in non-TARP loans, or what collateral it has accepted from "emergency" loans made to struggling firms, as Bloomberg reports.

* The Treasury Department providing a tax break to banks involved in acquisitions that could amount to $140 billion. The Washington Post reveals the change to the tax code was issued on Sept. 30, while Congress was debating the $700 billion TARP bill.

The bailouts are bad enough. But this kind of chicanery and lack of transparency makes me recall a line from another time when fear and deceit dominated Washington: Have they no shame, at long last?

ClusterStock wrote:The news that the Treasury Department and the Federal Reserve caved in to AIG's demands for a more generous bailout is a bad omen for bailout. It shows every company involved in the bailout--from investment banks, to commercial banks, to private banks, to insurance companies, to automakers--that they should take the money now and not worry about the strings attached or the costs: those can always be cut later.

The original $85 billion bridge loan facility to AIG was officially intended as allowing for an orderly sale of AIG assets. Behind the scenes government officials were saying that this wasn't a rescue of AIG, it was a liquidation. AIG was going to pay hefty interest on the loan, partly to make sure taxpayers would get a return for their investment in the company and partly to get AIG to pay off the loans as quickly as possible. It only took AIG two months to rework the deal into a long term loan with a relatively low interest rate. What's more, the government is now going to buy up assets, cancel liabilities and make an equity contribution.

What are the lessons for other recipients of bailout bucks?

First of all, don't worry about the promises you've made to the government about dividend payments. When the going gets rough, just explain to the government that you can't afford to make them.

Second, don't worry about restrictions on bonuses. You'll be able to recut this deal later. Just tell the Treasury you'll lose your key people if you can't pay them well enough.

Third, don't worry about limits on dividends to shareholders. Simply claim that those restrictions are preventing you from raising necessary private capital.

Fourth, don't worry about restrictions on what you can do with the money. Don't make loans under pressure from the government. Don't sell off troubled businesses. Make acquisitions. Invest in Chinese infrastructure. These Treasury guys are spineless. They'll never stop you. What's more, government officials have no upside incentive to police you. This is basically unencumbered cash.

Fifth, there's always more money. Once the government has invested billions in your business, the marginal cost of adding additional dollars compared to the loss from your failure guarantees that you'll always be able to get more money from the government.

Congratulations to everyone on your future ability to recut the deal with the government. And when we say "everyone" we mean everyone except the taxpayers. You're out of luck.

An interesting, albeit contrary, view of the Chinese economy:

More on China:

Factories Shut, China Workers Are Suffering

Not sure if I agree with everything he says, but it's good to consider contrary views.Why gold is likely heading down: Blame it on the 'China Price'

Saturday, November 8, 2008

AVNER MANDELMAN

Avner Mandelman is president and chief investment officer of Giraffe Capital Corp. and the author of The Sleuth Investor. amandelman@giraffecapital.com

A few months ago, amidst comfy consensus that China's prospects are rosy, this column noted that the country is really a bubble. This contrary opinion generated much e-mail flack. But then, an e-mail arrived from a Canadian engineer in China whose team had just finished a government project in a town so small that (in the guy's words), "dogs were chasing chickens down the street."

Despite the town's size, it sported dozens of condo towers and a posh hotel. And so, to celebrate the completion of the project, the Canadians went to dinner at the hotel's restaurant with the local bigwig (the son of an army general), who, by the way, also owned the hotel and condos.

They were the only diners present - the hotel was empty and dark, the condos emptier and darker. But there were lots of staff members, and during dinner the bigwig kept complaining that the Beijing bank that lent him the construction money was suddenly demanding interest. The cheek! How could one keep restive peasants employed if one had to pay interest?

My e-mailer noted wryly that all over China there are many such empty hotels and condos - and factories too - built with loans to the well-connected and intended to maintain employment, but also (allegedly) to allow loyal bigwigs to enrich themselves.

The economic value of such enterprises is, of course, zip, yet the "loans" are carried on the books of Chinese banks as good ones - just like U.S. mortgages to shirtless Joes and Janes were carried on Freddie Mac's and Fannie Mae's books before the mortgage corporations blew up. And, yes, just like loans to Sony or Sumitomo were carried by Japanese banks in the 1990s before the Japanese economy blew up.

And, similarly again, just as everyone in Congress knew that Freddie and Fannie would soon come to grief - or just as everyone in Japan in the '90s knew that most corporate loans were unpayable - the same is known in today's China. Yet most China bulls in the West maintain that the country's growth has merely slowed temporarily and will soon resume.

Will it? Not according to my informants. China, they insist, is like Japan of the '90s times three; it is Nortel writ large, maybe even Russia before the 1988 upheaval. You think this is extreme? Think again. Just last week Chinese Premier Wen Jiabao finally admitted that slow growth could risk "social stability." Slow growth? How about no growth? Or even negative growth? It's coming, and here's why.

You see, China, like Nortel and Japan and Soviet Russia, has been selling most things below true cost - which is the direct cost of production plus the cost of capital - and thus lost money on much of what it produced, and so destroyed much of its capital. A company that does so must eventually lay off workers and go bust. China, in my opinion, now faces similar risks, which Mr. Wen finally admitted.

Why does China sell below true cost? Because it is a dictatorship that wants to keep its restive people employed, and so, like (democratic) Japan before it, it keeps throwing good savings at bogus products. I say bogus because if you sell below true cost you create fictitious demand that otherwise wouldn't be there had the product been priced realistically. Thus the large factory you built to satisfy the goosed-up demand cannot be rebuilt once it wears out because you didn't include depreciation in the product's price.

Say you charged a mere $5 for a bottle of a 30-year-old Mouton Cadet because that's the cost of the corkers' wage, the bottle's glass, the unfermented grape juices and the paper label, and charged nothing for the 30 years of fermentation in an air-conditioned cellar. You would, of course, sell a large number of $5 Moutons, but would go bust once you had to rebuild the cellar.

Just like Japan did when it sold transistors for pennies when they really cost dollars if Japan had included the cost of capital; or just like Nortel a few years ago, when it sold products obtained (or improved) through acquisitions, for prices that excluded the amortized cost of the acquisition, in effect treating capital as having little or no cost; and just like China today, which sells nearly everything at the "China Price" - the cost of labour plus (alleged) pay-offs to, for example, generals' sons - while ignoring most capital costs because many loans do not have to be repaid. That's why much of China's manufacturing sector, although impressive to look at, is uneconomical, having been built to produce stuff that, were it priced to include the full cost of capital, might not have sold at all. For a while it worked - just like dot-coms or Japan or Russia - but now the party is over and China is about to meet the fate of all those who sell below true cost: mass layoffs, upheaval and perhaps a change of management.

Why should you care? Because of gold.

Recently gold has been very volatile, and could tack on $50, or even $100, in the short term. But longer term, if inflation - already quashed by Freddie and Fannie's blow-up - is further squashed by China's punctured bubble, gold is likely heading down.

Why? First, low inflation, even deflation, will lessen the need for inflation hedges. But second, and more crucial, as the West buys less of China's more fully priced products, and as China's cash needs escalate, its government, to feed the peasants and to maintain its power, will sell state assets - including gold. This, plus inflation, could push gold much lower than anyone thinks, perhaps to half its current price. How's that for a real contrary opinion?

More on China:

Factories Shut, China Workers Are Suffering

For decades, the steamy Pearl River Delta area of southern Guangdong Province served as a primary engine for China’s astounding economic growth. But an export slowdown that began earlier this year and that has been magnified by the global financial crisis of recent months is contributing to the shutdown of tens of thousands of small and mid-size factories here and in other coastal regions, forcing laborers to scramble for other jobs or return home to the countryside.

[CONT]

The Taiwanese chairman of the shoe factory, Zhuang Jiaying, did not return calls seeking comment. The collapse of the factory started a domino effect: Related businesses, like a smaller factory that put labels on Weixu’s shoe boxes, have also failed. Hundreds of additional laborers have lost their jobs, and more than 200 creditors have yet to collect millions of dollars, said Yang Qiusheng, the manager of the factory that handled the labels.

“I had to fire people who had worked for me for a long time,” he said. “When I see this shoe factory, this enterprise, I feel very sad and sorry. I never thought it would end like this.”

Just a reminder: despite 90% of Americans who pay attention to such things opposing the bailout, 88% of the House of Representatives was returned to office.

Nunc est bibendum

Like Jim Rogers said, "If we keep voting for turkeys, they're gonna keep sending us turkeys."simonov wrote:Just a reminder: despite 90% of Americans who pay attention to such things opposing the bailout, 88% of the House of Representatives was returned to office.

In other news, this week's drama will be the automaker's bailouts. This is a bad idea, even though I understand the repercussions of the Detroit Three going down. They ought to just go through bankruptcy and get restructured. It's not the end of the world, even though they make it out to be. These companies have bad management and their profitability was tied to large trucks and SUVs which no one wants anymore, or at least not in large quantities. Their union labor and health care costs are too high to make competitively priced small cars. Blame this on the UAW where among other things, each year $1.4 billion is spent on a "Job Bank" where workers are paid $31/hr to do crossword puzzles or take classes on how to deal blackjack and poker.

Source: http://www.usatoday.com/money/autos/200 ... htm?csp=34

Even the politicians pushing this bailout realize there are fundamental problems at these companies and that needs to change if any bailout is to succeed. Yet the management at GM don't want to go and the UAW president says workers won't make any more concessions, even if we give them a bailout:

That last statement is laughable and pretty arrogant. And they have the nerve to ask us for more money?Nov 15, 2:17 PM (ET)

COLUMBUS, Ohio (AP) - Even as Detroit's Big Three teeter on collapse, United Auto Workers President Ron Gettelfinger said Saturday that workers will not make any more concessions and that getting the automakers back on their feet means figuring out a way to turn around the slumping economy.

[CONT]

"We're here not because of what the auto industry has done," he said. "We're here because of what has happened to the economy."

Btw, the Detroit City Council is looking for their own $10 billion bailout.

Here's another interesting article on the automakers (the first reader comment is good too):

The Autos and Mentality That Ruined Detroit

Even more companies lining up for help:

Lobbyists Swarm the Treasury for Piece of Bailout Pie

The Autos and Mentality That Ruined Detroit

Even more companies lining up for help:

Lobbyists Swarm the Treasury for Piece of Bailout Pie

Textron, AEP Ask for Access to Commercial-Paper FundNY Times wrote:Published: November 11, 2008

The Treasury Department is under siege by an army of hired guns for banks, savings and loan associations and insurers — as well as for improbable candidates like a Hispanic business group representing plumbing and home-heating specialists. That last group wants the Treasury to hire its members as contractors to take care of houses that the government may end up owning through buying distressed mortgages.

“The biggest surprise was how quickly it went from ‘I don’t need this,’ to ‘How do I get in?’ ” said Michele A. Davis, the head of public affairs at the Treasury, who is Mr. Mason’s boss.

Underscoring the many ways companies can take part in the rescue fund, the Hispanic Chamber of Commerce and other Hispanic business groups met with Mr. Paulson to push for minority contracts in asset management, legal, accounting, mortgage services and maintenance jobs, like plumbing and masonry.

As the automakers have pushed for federal help, the trade groups for car dealerships and even boat dealerships are pressing their own cases. They argue that showrooms are feeling a squeeze between higher borrowing costs to finance their inventory and slowing consumer sales to move it out the door.

“We have been encouraged by reports that Secretary Paulson is looking to broaden the program,” said Mathew Dunn, head of government relations for the National Marine Manufacturers Association.

On Friday, the automobile dealers sent Mr. Paulson a letter urging him to keep them in mind.

Some lobbyists, Mr. Mason said, had called him even though they did not have any clients looking to get into the program or worried about its restrictions. They were merely seeking intelligence on which industries would be deemed eligible for assistance. He suspects they were representing hedge funds that wanted to trade on that information.

Bloomberg wrote: Nov. 14 (Bloomberg) -- A group of companies including Textron Inc., Nissan Motor Co. and American Electric Power Co. is pressing the Federal Reserve to expand purchases of commercial paper to include them.

The coalition wants the Fed to go beyond top-rated paper and buy debt with the second-highest grade, two people said on condition of anonymity.

While accepting lower-grade debt could reduce borrowing costs for a broader group of companies, it would also expose the taxpayer to greater risk. The request is one of a number of attempts to get a share of federal rescues, with industries from automakers to heating-oil retailers seeking funds.

``We are really creating a mindset where no one fails,'' said Adolfo Laurenti, a senior economist at Mesirow Financial Inc. in Chicago.

The two people familiar with the effort also identified Honda Motor Co., Home Depot Inc. and Dow Chemical Co. as being involved. Honda spokesman Edward Miller said today the company ``is not part of that group.'' David Winder, a Dow Chemical spokesman, didn't return a call.

Textron confirmed its inclusion, declining to comment further today.

bailout scrapbook

http://businesssheet.alleyinsider.com/2 ... -junkets-2

http://businesssheet.alleyinsider.com/2 ... -junkets-2

Governors seek US$48-M to retrain financial workers

Great, so not only do we get to bail out Wall Street, the Governors of New York, New Jersey and Connecticut now want us taxpapers to pay $12,500 for each of these laid off employees to get retraining and relocation benefits!

I know tons of people who have been laid off and they either got squat or a small severance from their company. Even is most of these people aren't the highly paid traders, why do financial services workers deserve special treatment? What about the Circuit City employees or the DHL employees? Are we going to start paying $12,500 for every laid off employee in the whole country? This is INSANE! My god man, the country is already broke!

Great, so not only do we get to bail out Wall Street, the Governors of New York, New Jersey and Connecticut now want us taxpapers to pay $12,500 for each of these laid off employees to get retraining and relocation benefits!

I know tons of people who have been laid off and they either got squat or a small severance from their company. Even is most of these people aren't the highly paid traders, why do financial services workers deserve special treatment? What about the Circuit City employees or the DHL employees? Are we going to start paying $12,500 for every laid off employee in the whole country? This is INSANE! My god man, the country is already broke!

Philipp Halstrick, Reuters Published: Wednesday, November 19, 2008

NEW YORK -- New Jersey and Connecticut, three of the states suffering the most from Wall Street's crisis, on Wednesday urged the federal government to approve a US$48 million grant to retrain financial workers.

Each individual would get a US$12,500 "training account" for 24 months to help pay for job searches and relocating, Connecticut Republican Gov Jodi Rell said in a statement.

Ms. Rell, New York Gov David Paterson and New Jersey Gov Jon Corzine, both Democrats, sent a letter to U.S. Labor Secretary Elaine Chao requesting the grant.

The tri-state area is expected to lose 160,000 workers by the end of this year and 82,000 financial sector jobs by the end of next year, Ms. Rell said.

Many of the employees are "not highly-paid securities traders, but administrative and computer support personnel," she said.

"It is unlikely that they will return to financial sector jobs and they will need retraining and other support services to help them transition back into the workforce."

The jobless rate for the three states has climbed to 5.8% from 4.5% in the past three months, Ms. Rell said. The three states are trying to identify new and highly paid jobs in industry and education.

This comes amid news that Deutsche Bank will sack about one in seven traders, roughly 900 staff, in its single biggest cut to investment banking since the onset of the financial crisis. Sources with knowledge of the Deutsche Bank plan told Reuters.

The German bank, which had initially managed to duck the worst of the financial storm, is seeing frigid markets sap earnings in what used to be the engine room of its business -- investment banking and trading.

The staff will be cut from Deutsche Bank's global markets division which employs around 7,000 traders. Most are in London and New York, and those locations are where the axe will fall hardest, sources said.

These individuals are among the highest paid in the City of London and on Wall Street. They would typically take a disproportionately large share of the 13-billion euros (US$16 billion) Deutsche paid to its more than 80,000 staff last year.

Deutsche made its name creating and trading stock-market and debt products. But this business has been hit by the markets freeze that also forced thousands of redundancies at rival UBS which cut about 4,600 jobs in investment banking alone.

"There will be huge adjustments to those trading businesses that have stopped working in the crisis," one source told Reuters, adding that the areas of proprietary trading and structured products would be hit.

"We are talking about cuts of about 900 jobs," the source said.

Other businesses such as foreign exchange trading will be largely unaffected by the cuts, the source added. Deutsche Bank declined to comment.

"Given that trading continues to go badly, it would have been wishful thinking to believe Deutsche would not have to make big cuts," said Konrad Becker, an analyst at German bank Merck Finck.

© Thomson Reuters 2008

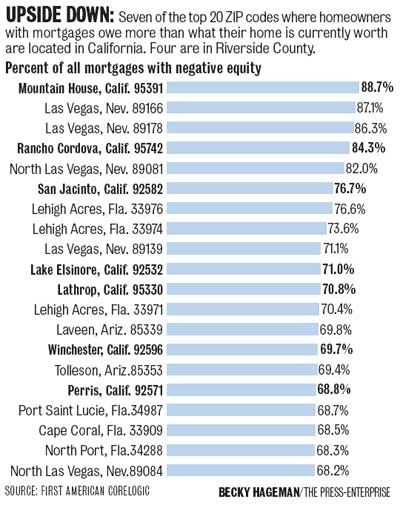

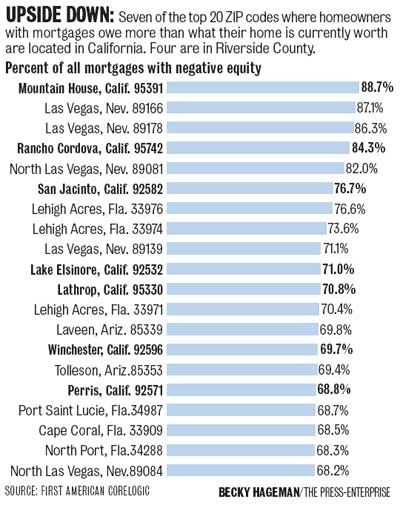

A Town Drowns in Debt as Home Values Plunge

A sea of unwanted auto imports

Where Homes Are Worth Less Than the MortgageBy DAVID STREITFELD

Published: November 10, 2008

MOUNTAIN HOUSE, Calif. — This town, 59 feet above sea level, is the most underwater community in America.

Because of plunging home values, almost 90 percent of homeowners here owe more on their mortgages than their houses are worth, according to figures released Monday. That is the highest percentage in the country. The average homeowner in Mountain House is “underwater,” as it is known, by $122,000.

The Martinezes bought their house in early 2005 for $630,000. It is now worth about $420,000. They have an interest-only mortgage, a popular loan during the boom that allows owners to forgo principal payments for a time.

But these loans eventually become unmanageable. In 2015, Mr. Martinez said, his monthly payments will be $12,000 a month. He laughed and shook his head at the absurdity of it.

A sea of unwanted auto imports

Published: November 19, 2008

LONG BEACH, California: Gleaming new Mercedes cars roll one by one out of a huge container ship here and onto a pier. Ordinarily the cars would be loaded on trucks within hours, destined for dealerships around the United States. But these are not ordinary times.

In the 150-acre terminal where Toyotas are unloaded, there is a sea of Corollas, Camrys and RAV4s. The mere presence of so many cars is not unusual, given that Toyota brings in 250,000 cars a year in biweekly shipments. But in a sign that something is amiss, dozens of tractor-trailers that transport new cars to dealers sat empty last week amid the rows of Toyotas.

Kurt Golledge, 48, was one of just two truckers loading his green, 75-foot-long hauler with cars last week. Golledge said eight of his colleagues were laid off this month because Toyota dealers did not want more deliveries.

"I was dropping cars in Henderson, Nevada, about a month ago and the dealer told me: 'Take 'em somewhere else and dump 'em,' " said Golledge, who works for a company called Allied Systems. "All the dealers are telling us the same thing."

- JMunaretto

- Posts: 370

- Joined: Thu Feb 07, 2008 11:03 am

wait, does this mean I can buy a mercedes on the cheap?!

Ha! If we end up in a depression they won't be able to give them away!JMunaretto wrote:wait, does this mean I can buy a mercedes on the cheap?!

I hate to sound like a Debby Downer, but things really aren't looking too good. Two more California banks (Downey S&L and PFF B&T) were seized yesterday by federal regulators and sold to US Bancorp. Citigroup is not looking too good either. Then there are the 1 quadrillion dollars in derivatives floating around out there--those ticking time bomb, financial weapons of mass destruction that could bring everything down. I'll explain about that in a future post.

Meanwhile, looks like Obama is about to appoint Timothy Geithner, current New York Fed President, as the Treasury Secretary. I'm not sure if I like that. He, along with Paulson and Bernanke, orchestrate the buyout of Bear Stearns by JPMorgan. Then earlier this month, ex-Bear Stearns exec Michael Alix was named a senior vice president in the bank supervision group of the Federal Reserve Bank of New York. Get his, Michael Alix was the Senior Risk Manager at Bear Stearns since 2006! This guy is obviously incompetent since he was the Senior Risk Manager and still ran Bear Stearns into the ground. Yet now he's a VP at the New York Fed and is in charge of supervising banks?? ROFLMAO!!! Incredible. I have to wonder about Geithner, but who knows maybe it will work out. I sure hope it does, but if they keep printing more money out of thin air it's never going to work out.

Well, there you have it. They've now announced a massive bailout for Citigroup. The government will hand over $20B in cash to Citigroup (on top of the $25B already given to them) and guarantee losses on up to $300B in risky loans and securities. The government, i.e. you the taxpayer, will "absorb" 90% of the losses and Citigroup 10% after Citigroup assumes the first $29B in losses. Is that a sweetheart deal or what? I'd go gambling in Vegas too is someone else "absorbs" 90% of my losses! Woo-hoo!!Tim wrote:Citigroup is not looking too good either.

This whole thing sucks. Check out this NY Times article on those buffoons at Citigroup: http://www.nytimes.com/2008/11/23/busin ... ml?_r=2&hp

Like Kitfox mentioned in my other thread on the bailouts, it's no accident that these companies got "too big to fail." They got too big because these damn corporations paid off our corrupt politicians to repeal the Glass-Steagall Act in 1999. The financial corporations spent nearly $200 million in lobbying to get this act repealed. This law was passed during the Depression in 1933 to separate commercial and investment banking in order to protect depositors from the hazards of risky investment and speculation.

Phil Gramm (former Republican Senator from Texas) was the main guy who wanted the law repealed (it was mainly done for Travelers Group to merge with Citibank at the time) but both Democrats and Republicans, were all on board to repeal this law: http://www.counterpunch.org/kaufman09192008.html

Even to this day Bill Clinton thinks the repeal of this law (which he signed) has nothing to do with the current crisis. There are other causes too, but you would have to be a complete moron to think this has nothing to do with it.

Source: http://www.businessweek.com/magazine/co ... 409948.htmI don't see that signing that bill had anything to do with the current crisis. Indeed, one of the things that has helped stabilize the current situation as much as it has is the purchase of Merrill Lynch by Bank of America, which was much smoother than it would have been if I hadn't signed that bill ... On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence.

Another big factor in the current crisis is in 2004, at the request of the major Wall Street investment houses, including Goldman Sachs, then headed by Paulson, the U.S. Securities and Exchange Commission agreed unanimously to release the major investment houses from the net capital rule, the requirement that their brokerages hold reserve capital that limited their leverage and risk exposure. Basically this gave the investment banks a no-limit credit card to do whatever they wanted.

Too big to fail..yeah right. That 1999 repeal had little to do with it BTW. Bottom line is these guys are crooks and would have gone somewhere else to get money. Now they have the taxpayers wallet and will extract every penny available.

Take a look at this guy Sandy Weil...he was a low level crook way back in the day and started in the Milken era(and was in the same group back in the day). Many people are pointing at him as the one who discovered how much money was to be taken from being a bank and investment house, in fact, he had a combined entity well over a year before the repeal with Greenspans blessing(Im not kidding to say this is mafioso). The repeal was brought up last time with the worldcom and Enron scandals......what a joke...

So now they are taking over government...big purse to take there...so thats it then, it will be a depression...not that theres anything anyone can do about it, these things happen all the time...I mean the last time the country went into a depression in was crooks running the show.

These guys are harmless compared to others out there...so if taxpayers want to throw blood in the water and feed these smaller fish, they shouldnt be surprised if the big fish dont come in and take it all...the hedge funds....crooks with big money and even bigger leverage than governments. I wonder what they are thinking about the free money being handed out....people like Jim Rogers, Soros, Paul Singer, etc....well Soros may be in already...then its really too late...didnt I see him advising the congress hehehehe...they looked like they couldnt wait to do whatever he said to do.

Take a look at this guy Sandy Weil...he was a low level crook way back in the day and started in the Milken era(and was in the same group back in the day). Many people are pointing at him as the one who discovered how much money was to be taken from being a bank and investment house, in fact, he had a combined entity well over a year before the repeal with Greenspans blessing(Im not kidding to say this is mafioso). The repeal was brought up last time with the worldcom and Enron scandals......what a joke...

So now they are taking over government...big purse to take there...so thats it then, it will be a depression...not that theres anything anyone can do about it, these things happen all the time...I mean the last time the country went into a depression in was crooks running the show.

These guys are harmless compared to others out there...so if taxpayers want to throw blood in the water and feed these smaller fish, they shouldnt be surprised if the big fish dont come in and take it all...the hedge funds....crooks with big money and even bigger leverage than governments. I wonder what they are thinking about the free money being handed out....people like Jim Rogers, Soros, Paul Singer, etc....well Soros may be in already...then its really too late...didnt I see him advising the congress hehehehe...they looked like they couldnt wait to do whatever he said to do.

Here is a flashback link...this was way back in 2003!

http://discuss.washingtonpost.com/zforu ... 050903.htm

Main sentance:"But what each of these industries learn is that the public quickly forgets, and the mode in Washington is to "trust the market" to do its own correcting"

..guess not anymore since the correcting is now being done by the same crooks.

Dont worry , it aint personal, its just business

Dont worry , it aint personal, its just business

http://discuss.washingtonpost.com/zforu ... 050903.htm

Main sentance:"But what each of these industries learn is that the public quickly forgets, and the mode in Washington is to "trust the market" to do its own correcting"

..guess not anymore since the correcting is now being done by the same crooks.

I disagree that the 1999 repeal had little to do with it. I agree that our country is infested with crooks from the top down.

Jim Rogers doesn't like the bailouts.

One day people will finally get out the pitchforks and torches and start a bloody revolution because "I'm as mad as hell and....

Jim Rogers doesn't like the bailouts.

One day people will finally get out the pitchforks and torches and start a bloody revolution because "I'm as mad as hell and....

Jim Rogers doesnt like US bailouts/spending since hes not invested in this country...but he does like Chinese spending..."The investor said he has been buying Chinese agricultural stocks amid government measures to bolster economic growth. Other industries he favors are infrastructure in China, water and tourism in Asia. He didn’t name any specific stocks. "

Please dont think these internationalist guys have any real interest in the USA...its insulting to them.

Anyways, heres an article of interest:

http://seekingalpha.com/article/113198- ... -beginning

Im in the camp that says this has all the signs of a depression...just sort of in denial about it, but less than 99% of americans.

For my 2 cents, I dont define a depression as statics but statistical behavior. To explain that, it means how the economy behaves to certain events. I think a telltale sign of a depression is the inability of an economy to recover, not the straight-downard spiral so often mentioned. You can always put $1 million dollars in every persons hands if that were the case. Basically if production is declining, then the economy is unable to recover. Thats due to any recovery spiking prices, which then collapses demand. The only way to get out is to increase demand/production and lower prices, something that happened in WWII,although it was at least somewhat paid for by sharp wage controls.

If thats correct, then the California budget as tossed about will deepen this states troubles in a way that is not mentioned. It will just take us one step down the ladder..but we will see....best to think the economy will recover one day soon. There is this term called a sink which is beyond anything I know. It basically means theres a counter reaction to any economic behavior...usually exampled by foxes/rabbits...such as here..

http://academic.evergreen.edu/curricula ... lculus.htm

Greenspan also alluded to the hope of immigration increases..so there are possibilities.

But if not, for the idea of a cheap new mercedes...yeah if you can find one. As production gets cut, there wont be enough new cars for everyone...but dont worry about incentives ending. Any price increase in a depression has been met by a stiff collapse in demand...something oil producers have been finding out. In this case, car makers think they can cut production to meet lower demand....in that case just go out of business to guarantee tight capacity.

Please dont think these internationalist guys have any real interest in the USA...its insulting to them.

Anyways, heres an article of interest:

http://seekingalpha.com/article/113198- ... -beginning

Im in the camp that says this has all the signs of a depression...just sort of in denial about it, but less than 99% of americans.

For my 2 cents, I dont define a depression as statics but statistical behavior. To explain that, it means how the economy behaves to certain events. I think a telltale sign of a depression is the inability of an economy to recover, not the straight-downard spiral so often mentioned. You can always put $1 million dollars in every persons hands if that were the case. Basically if production is declining, then the economy is unable to recover. Thats due to any recovery spiking prices, which then collapses demand. The only way to get out is to increase demand/production and lower prices, something that happened in WWII,although it was at least somewhat paid for by sharp wage controls.

If thats correct, then the California budget as tossed about will deepen this states troubles in a way that is not mentioned. It will just take us one step down the ladder..but we will see....best to think the economy will recover one day soon. There is this term called a sink which is beyond anything I know. It basically means theres a counter reaction to any economic behavior...usually exampled by foxes/rabbits...such as here..

http://academic.evergreen.edu/curricula ... lculus.htm

Greenspan also alluded to the hope of immigration increases..so there are possibilities.

But if not, for the idea of a cheap new mercedes...yeah if you can find one. As production gets cut, there wont be enough new cars for everyone...but dont worry about incentives ending. Any price increase in a depression has been met by a stiff collapse in demand...something oil producers have been finding out. In this case, car makers think they can cut production to meet lower demand....in that case just go out of business to guarantee tight capacity.

% that favor solution:

Alcohol excise tax 5 cents per drink:85%

Raising the state income tax rate paid by the wealthiest residents :72%

Asking federal govt for assistance: 62%

Raising the state taxes paid by corporations:60%

Vehicle license fee increase of $12: 58%

Sales tax increase of 1.5 cents: 52%

Expansion of sales tax(car repairs,golf,etc): 47%

Major spending cut priorities if neccessary:

#1: Prision & Corrections.

http://www.ppic.org/content/pubs/survey/S_109MBS.pdf

Alcohol excise tax 5 cents per drink:85%

Raising the state income tax rate paid by the wealthiest residents :72%

Asking federal govt for assistance: 62%

Raising the state taxes paid by corporations:60%

Vehicle license fee increase of $12: 58%

Sales tax increase of 1.5 cents: 52%

Expansion of sales tax(car repairs,golf,etc): 47%

Major spending cut priorities if neccessary:

#1: Prision & Corrections.

http://www.ppic.org/content/pubs/survey/S_109MBS.pdf